In short, it’s interest on interest and speeds up the growth of your investments. More frequent compounding periods means greater compounding interest, but the frequency has diminishing returns. This example shows the interest accrued on a $10,000 investment that compounds annually at 7% for four different compounding periods over 10 years.

How Much Money Do I Need To Retire?

The Federal Reserve’s ongoing battle to tame inflation has kept interest rates high. You can use a high-interest savings account to leverage the power of compound interest. Liliana Hall is a writer for CNET Money covering banking, credit cards and mortgages. Previously, she wrote about personal credit for Bankrate and CreditCards.com. She is passionate about providing accessible content to enhance financial literacy. She graduated from the University of Texas at Austin with a bachelor’s degree in journalism, and has worked in the newsrooms of KUT and the Austin Chronicle.

Formula of Daily Interest Calculator

Welcome to a strategic approach to building wealth through long-term investing using our Compound Interest Calculator. This tool is not just a calculator; it’s your guide to understanding and harnessing the power of compound interest. With the added convenience of downloading results in PDF or XLS formats, planning and tracking your financial growth has never been easier. As the main focus of the calculator is the compounding mechanism, we designed a chart where you can follow the progress of the annual interest balances visually.

Daily Compound Interest Formula

As an example, you may wish to only reinvest 80% of the daily interest you’re receivingback into the investment and withdraw the other 20% in cash. With some types of investments, you might find that your interest is compounded daily, meaning that you’re earning interest on both the principalamount and previously accrued interest on a daily basis. This is often the case with trading where margin is used (you are borrowing money to trade). One costly factor is that unpaid interest from previous cycles gets added to your balance, meaning you end up paying interest on interest over time.

Why Use Our Compound Interest Calculator for Long-Term Investing

The calculations results given by the compound interest calculator serve only as guide for potential future value. Please speak to an independent financial advisor for professional guidance. The effective interest rate (or effective annual rate) is the rate that gets paid after all the compounding. When compounding of interest takes place, the effective annual rate becomes higher than the overall interest rate. The more times the interest is compounded within the year, the higher the effective annual rate will be. Compound interest is a type of interest that’s calculated from both the initial balance and the interest accumulated from prior periods.

APR vs. interest rates

Example, I loan a customer $13,000.00 on a note, 10% annual (360 days) simple interest. Generally, these are 6-month notes, but due net operating profit after tax definition dates are not important. The daily compound interest rate is easy to calculate once you have the APR (annual percentage rate).

A credit score is a number between 300 and 850 that represents a borrower’s creditworthiness; the higher, the better. Good credit scores are built over time through timely payments, low credit utilization, and many other factors. Credit https://www.accountingcoaching.online/ scores drop when payments are missed or late, credit utilization is high, total debt is high, and bankruptcies are involved. In most developed countries today, interest rates fluctuate mainly due to monetary policy set by central banks.

When the unemployment rate is high, consumers spend less money, and economic growth slows. However, when the unemployment rate is too low, it may lead to rampant inflation, a fast wage increase, and a high cost of doing business. As a result, interest rates and unemployment rates are normally inversely related; that is, when unemployment is high, interest rates are artificially lowered, usually in order to spur consumer spending. Conversely, when unemployment within an economy is low and there is a lot of consumer activity, interest rates will go up. Below you can find information on how the compound interest calculator works, what user input it accepts and how to interpret the results and future value growth chart.

- For other compounding frequencies (such as monthly, weekly, or daily), prospective depositors should refer to the formula below.

- Use the prior assumptions of an initial value of $1,000 and 200 days, and now set the interest rate to “annual” and 10.95%.

- Although the interest rate may be less than other investments, this adds up over time.

- To do calculations or learn more about the differences between compounding frequencies, please visit the Compound Interest Calculator.

- The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation.

The faster you earn interest, the more your investment will grow, or in the case of debt, the more money you will have to repay. Conclude by reaffirming the transformative potential of daily compound interest in wealth accumulation. Encourage readers to utilize your online calculator to explore and plan their financial future, emphasizing the calculator’s role in making informed investment decisions.

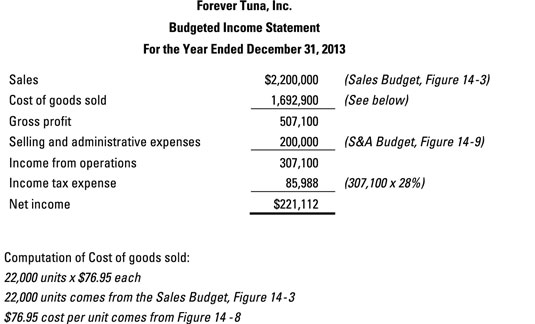

Compounding interest is the process where the interest earned on an investment is reinvested to generate additional interest over time. These example calculations assume a fixed percentage yearly interest rate. If you are investing your money, rather than saving it in fixed rate accounts,the reality is that returns on investments will vary year on year due to fluctuations caused by economic factors.

Your interest also earns interest, therefore growing your account balance. Compound interest is calculated by applying an exponential growth factor to the interest rate or rate of return you’re using. The good news is that there are plenty of excellent calculators that will do the math for you. Daily compounding increases the total interest accrue because interest is calculate and add to the principal amount every day, leading to interest being earn on previously accrue interest. The calculation reveals the interest accrued over the 30-day period, demonstrating the practical application of the formula and highlighting the impact of daily compounding on the overall interest. Understanding this formula is crucial for anyone looking to calculate daily interest accurately.

If you choose a higher than yearly compounding frequency, the diagram will display the resulting extra or additional part of interest gained over yearly compounding by the higher frequency. Thus, in this way, you can easily observe the real power of compounding. The daily interest calculator will calculate interest with either a daily interest rate or an annual interest rate. Just make sure that the correct interest rate and time period are used to calculate accurately.

It’s designed to help users plan their financial future, whether for retirement, saving for a home, or understanding the potential growth of their investments. The compound interest formula is an equation that lets you estimate how much you will earn with your savings account. It’s quite complex because it takes into consideration not only the annual interest rate and the number of years but also the number of times the interest is compounded per year. Calculate the future value of an investment or debt where the principal is compounded daily. Enter the initial value, interest rate, and time period in days to find it.

When not working, she is probably paddle boarding, hopping on a flight or reading for her book club. Compound interest is the phenomenon that allows seemingly small amounts of money to grow into large amounts over time. To take full advantage of the power of compound interest, investments must be allowed to grow and compound for long periods. Similar to the market for goods and services, the market for credit is determined by supply and demand, albeit to a lesser extent. When there exists a surplus of demand for money or credit, lenders react by raising interest rates.

If you have a question about the calculator’s operation, please enter your question, your first name, and a valid email address. If you will be entering more than one interest period, be sure to enter all periods in the order they occurred, from first to last. Note that the compounding occurs because we are raising 1 plus the interest rate r to the https://www.business-accounting.net/what-is-an-installment-sale/ power of t. Under simple interest, the principal is multiplied by the interest rate so no compounding occurs. Interest Earned – How much interest was earned over the number of years to grow. Expectancy Wealth Planning will show you how to create a financial roadmap for the rest of your life and give you all of the tools you need to follow it.